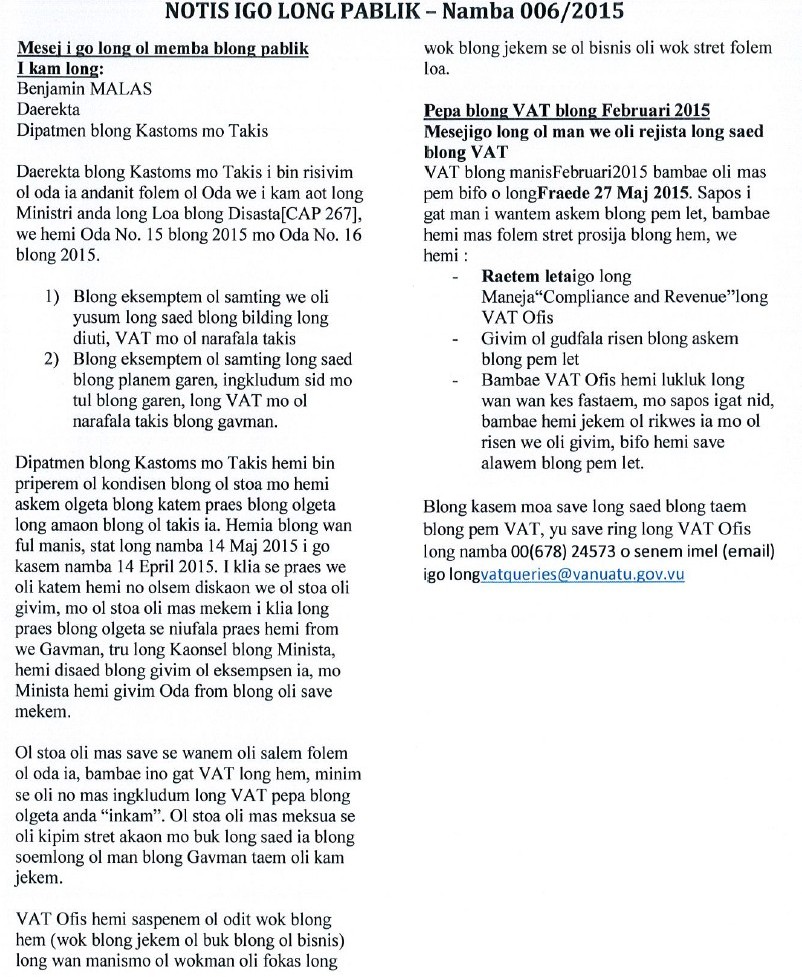

The following Directions were given to the Director of Customs and Inland Revenue Department covered under Order No. 15 of 2015 and Order No. 16 of 2015 under the National Disaster Act [CAP 267].

1- Exempt duty, VAT and other Taxes on building and construction materials

2- Exempt VAT and other government taxes on planting materials including seeds and gardening tools.

The Department of Customs and Inland Revenue has prepared conditions for suppliers and have instructed them to reduce their selling price by the appropriate tax percentages for one month (14th March 2015 to 14th April 2015). These reductions are not discounts given by the suppliers and the suppliers are required to clearly indicate that the reduction is due to tax and duty exemptions as per the Council of Ministers Decisions and effected under the Orders and Directions issued.

Suppliers are advised as the sales made under these orders are exemptions it must be treated as outside the scope of VAT therefore the sales will not be recorded in the appropriate VAT returns as income. The suppliers are advised to keep proper records/documents for verification during the compliance and/or audit visits.

The VAT Office has suspended all audit activities for a month and has assigned all staff to focus on compliance tasks.

February 2015 VAT Return

Message to All VAT Registered Persons

The February 2015 VAT returns are due on Friday 27th March 2015. Request for extension of time for lodgments must follow the normal process.

- Must be in writing and addressed to the Manager Compliance and Revenue at the VAT Office

- Must provide valid reasons for the extension

- Extensions will only be approved on case by case basis and if required verification and validation checks of the reasons provided will be conducted by the VAT Office.

For more information on VAT Return due dates please contact the VAT Office on phone: 00(678) 24573 or email us at