The VAT Office from 1st June 2015 will take a U-Turn Approach from its Plan 1A that was put in place due to tropical cyclone Pam. This means that the VAT Office will totally focus on enforcement activities from 1st June 2015.

Archived Articles

This section contains a wide variety of archived articles, notices and news from DCIR including media releases and publications.

Inland Revenue receives further Orders on VAT exemptions due to tropical Cyclone Pam

The Director of Customs and Inland Revenue Department was given the following Directions under the National Disaster Act [CAP 267].

Customs prepare for enforcement of IPR laws

As per Customs public notice number 4 of 2015, dated 7th February 2015, Customs will commence the enforcement of the Intellectual Property Rights (IPR) laws on 7th April 2015. Customs Officials are therefore undergoing IPR trainings this week in both Port Vila and Luganville in preparation for the enforcement of these laws.

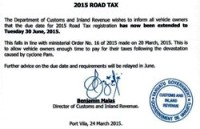

Public Notice No.006 of 2015

Attention: Members of the general public

Issued by:

Benjamin MALAS

Director

Customs and Inland Revenue Department.

VALUE ADDED TAX (VAT) informs VAT Registered Persons to notify change of status

The VAT Office would like to remind all VAT Registered Persons of Section 14 of the VAT Act No.12 of 1998 [CAP 247] (the Act) which states that Registered Persons to notify the Director of Customs and Inland Revenue via the VAT Office of change of status.

ICT Resource Development within DCIR

Vanuatu Customs and Inland Revenue has been for the last 15 years using the ASYCUDA++ system which uses object oriented tools in a client/server environment on a Linux and DOS Operating System, based on a relational data base management system (RDBMS).

Vanuatu Customs and Inland Revenue participated in the 2nd Regional UNNExT Masterclass workshop on Single Window

The 2nd World Customs Organization (WCO) and United Nations Economic and Social Commission for Asia Pacific (UNESCAP) UNNExT Masterclass workshop on Single Window system was successfully organized by ROCB A/P and was held from 12th to 21st January, 2015.

Inland Revenue Implements Return and Debt Collection Plan

The VAT Office as from 1st January 2015 implemented its modernized Return and Debt Collection Plan and Process which encourages balanced and differentiated approaches to collecting VAT debts and returns. The plan demanded the establishment of a recovery team that only focused on the VAT outstanding.

Inland Revenue Identifies VAT Registered Persons Mostly On Refund Situations and Should Not Be Registered For VAT Purposes

The VAT Office is continuingly analyzing its VAT registration data to identify all VAT registered persons who initially met all the VAT registration requirements, however have never been engaged in a taxable activity since registered for VAT purposes.

Prime Suspect in the Tax Fraud Case Pleaded not Guilty

The prime suspect in the Tax Fraud case had pleaded not guilty before Justice Fatiaki on Monday 2nd February, 2015.

Customs to seize Counterfeit Goods

As part of the international community, Vanuatu Customs has a role to play in combating the production and circulation of counterfeit goods around the world. On the local context, fighting against the importation of counterfeit goods is part of Customs duty to protect our communities from counterfeit goods which are usually of poor quality and, or not safe for our consumers.

Customs Record Keeping Requirements

The objective of this article is to inform all Importers, Exporters the Owners and the Licensees of the record keeping requirements. Observations suggest generally some importers and Exporters or Owners or Licensees do not keep their import and export documentations properly or if not in the manner required by Customs laws.